Every US citizen who travels to Canada must follow a specific set of tax obligations

Moving from the US to Canada for work and travel? Confused about your tax obligations? You’ve come to the right place.

Here’s our guide to everything you need to know about your tax obligations and entitlements as a US citizen in Canada.

Q1 – Do I need to file a tax return in Canada?

A – Yes! You’ll have to file a tax return in Canada. And in order to file a complaint and accurate tax return, you’ll need to determine your tax residency status.

Q2 – What is my tax residency status in Canada?

A – You will be considered a non-resident for tax purposes if:

- you normally, customarily, or routinely live in another country and are not considered a resident of Canada

Or

- you do not have significant residential ties in Canada

And

- you lived outside Canada throughout the tax year

Or

- you stayed in Canada for less than 183 days in the tax year

If you’ve never before filed a tax return in Canada, you’re in Canada to work and travel for a year or two, and you plan on staying for that amount of time and then leaving Canada, it’s very likely that you should file as a non-resident for tax purposes.

You’ll be considered an ordinary resident in Canada for tax purposes if Canada is the place where you, in the settled routine of your life, regularly, normally or customarily live.

To be considered a resident you will need to have significant and secondary ties to the country.

Significant ties include:

- A spouse or common-law partner

- A house or apartment (own or renting)

- Dependants

Secondary ties include:

- You’re planning on staying in Canada past your work and travel visa expiry and are applying for Permanent Residence

- Canada should be the place where you customarily live

If any of the above residential ties are unfamiliar to you and you’re in Canada to work and travel, you should file as a non-resident.

If you’re confused about your residency status or how to file a compliant tax return you can contact Taxback.com. Their tax team offers a range of Canadian tax services.

Q3 – Am I entitled to any Canadian tax credits?

A – As a US citizen in Canada there are some conditions you must meet in order to be entitled to a tax-free allowance (or personal tax credit) which would allow you to earn up to $11,635 without paying tax.

When you start a new job in Canada you will have to fill out a TD1 personal tax credit return form. This form will determine your eligibility for personal tax credits.

Whether you’re eligible for the credits will depend on what’s known as the 90% rule.

You May Also Like:

WHAT IS A TD1 FORM?

Q4 – What is the 90% rule?

A – This rule basically means that if you earned more than 10% (net) of your income outside Canada in a particular tax year, you can’t avail of the personal tax credits. However, if you earned 90% or more of your income within Canada, then you can claim the credits.

In other words, you will need to bear this rule in mind if you earned income in the US in the same tax year that you moved to Canada.

You should factor this rule in when you’re filling in your TD1 form. In a case where you didn’t earn 90% of your income in Canada for that year then you should enter 0 in box 13 and tick ‘No’ on the non-resident question on the form.

If you’re unsure about the amount of income you can earn outside of Canada during the year, then it’s safer not to claim the credits. Even if you end up overpaying tax, you’ll get a higher tax refund when you file your tax return. But, if you don’t fill out your TD1 correctly, you could end up owing money to the Canadian authorities.

Q5 – How much tax will I pay in Canada?

A – Taxpayers with employment income in Canada are liable to pay both Federal and Provincial tax at the below rates, as well as Canada Pension Plan and Employment Insurance.

Federal Tax Rates and Brackets

*There is a tax-free allowance, which means you can earn up to this amount without paying federal tax on your income.

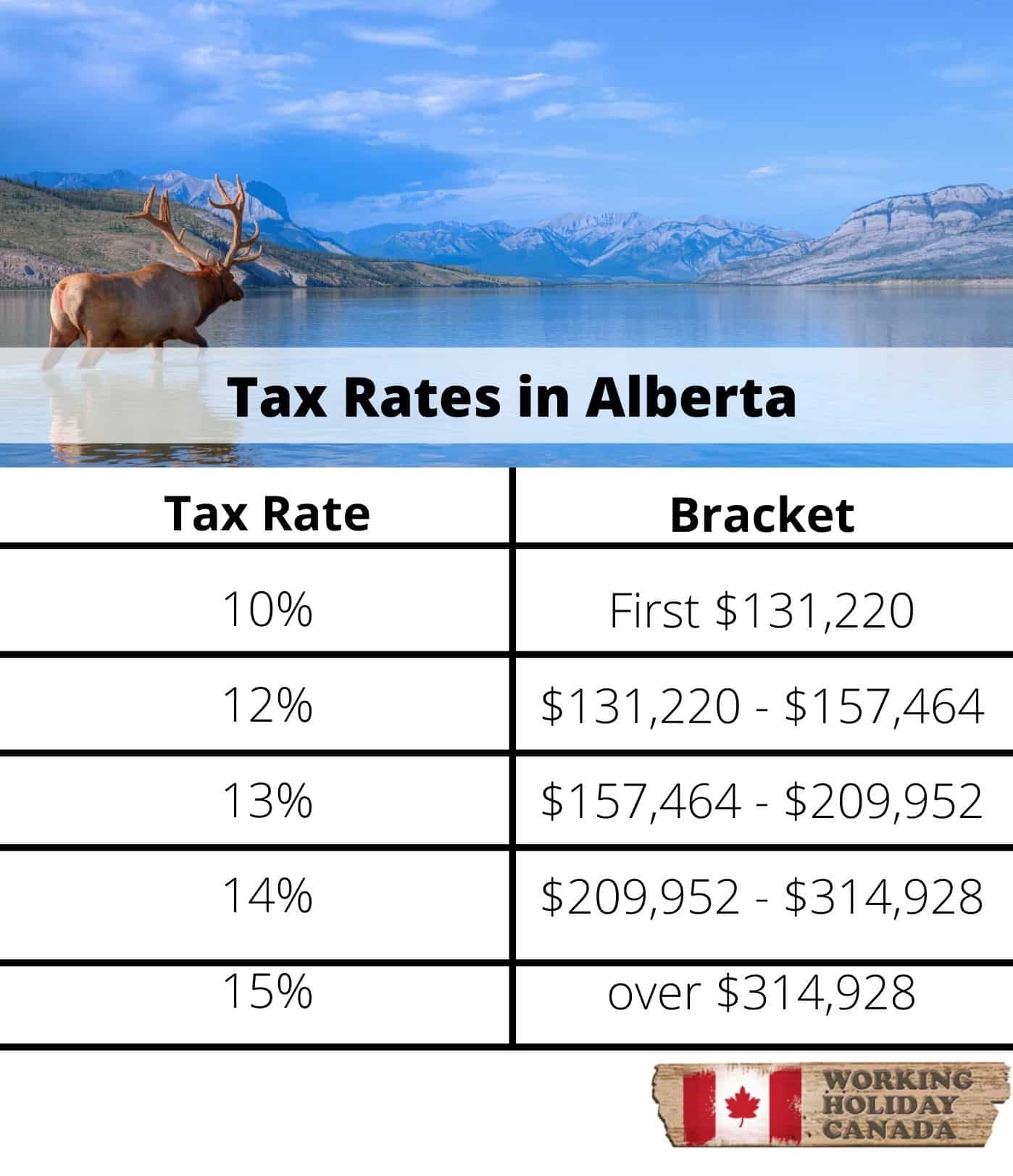

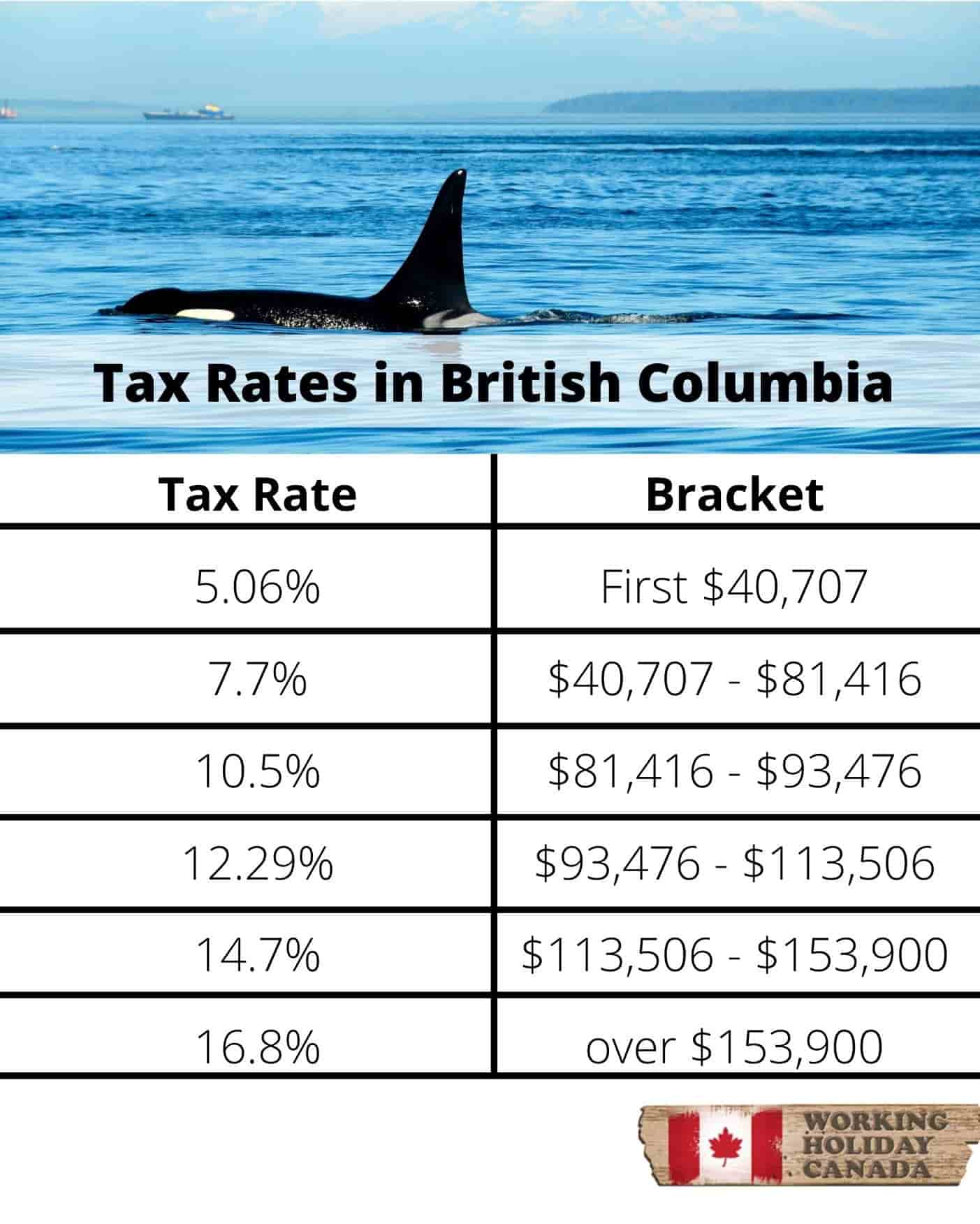

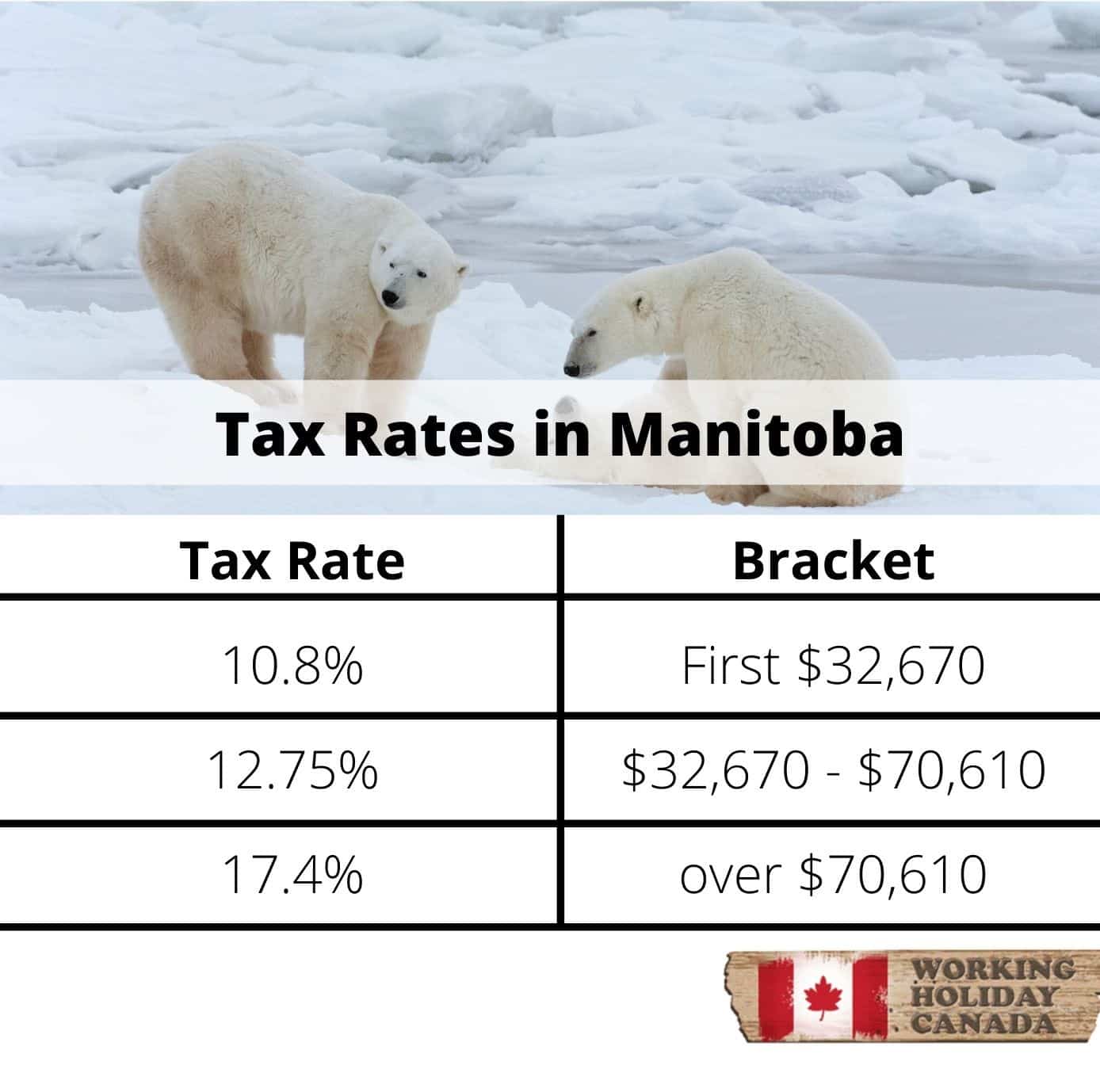

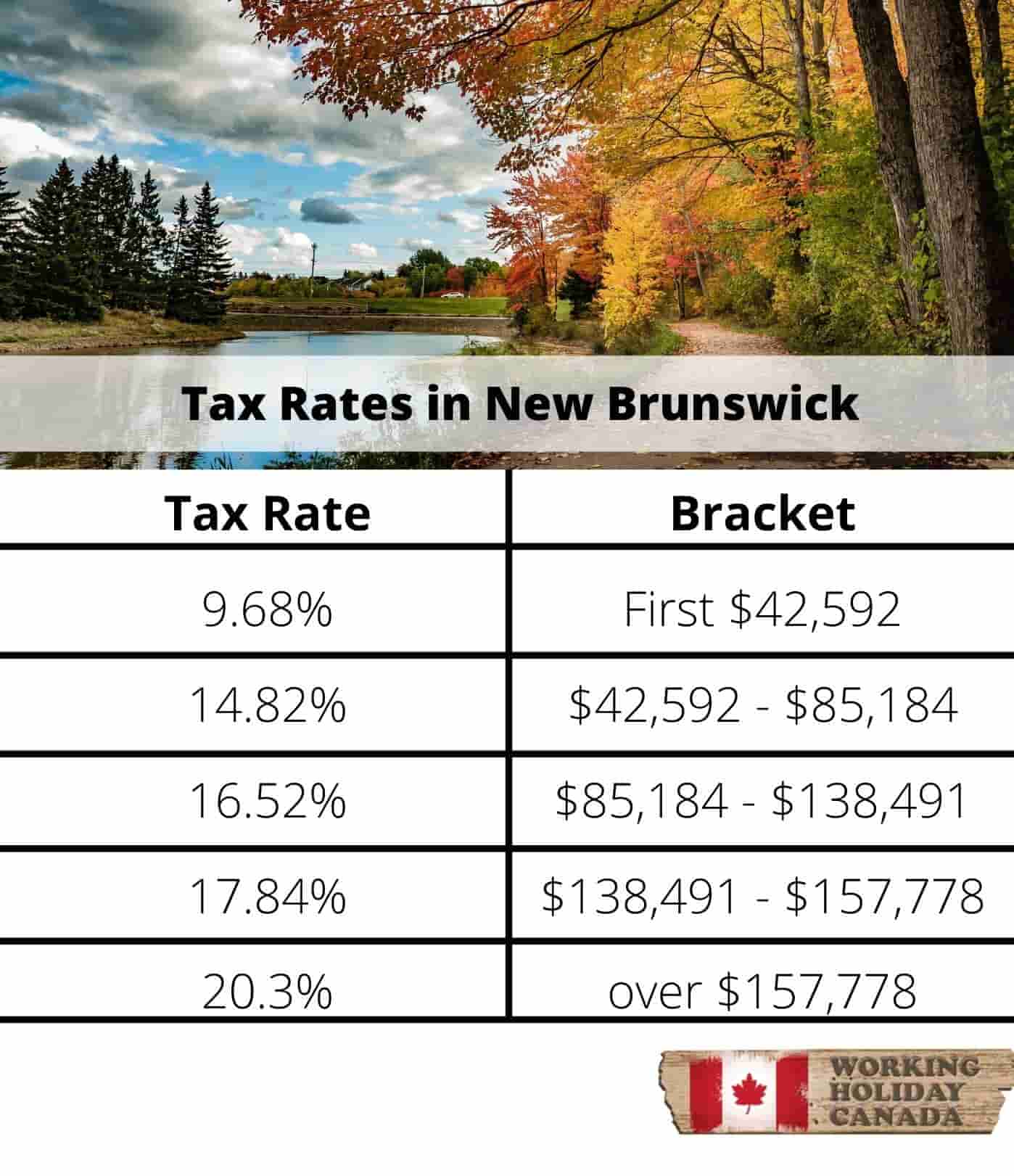

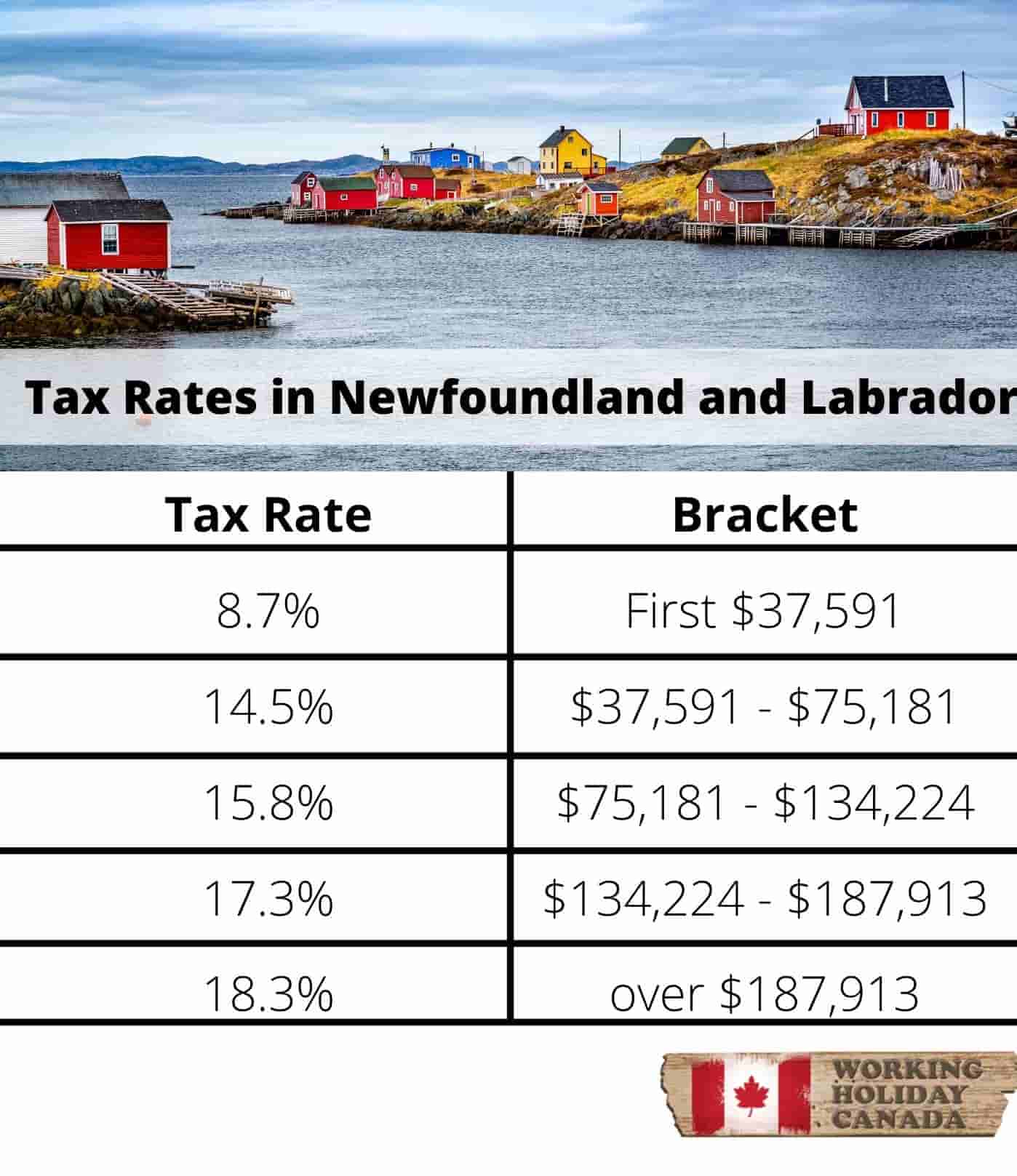

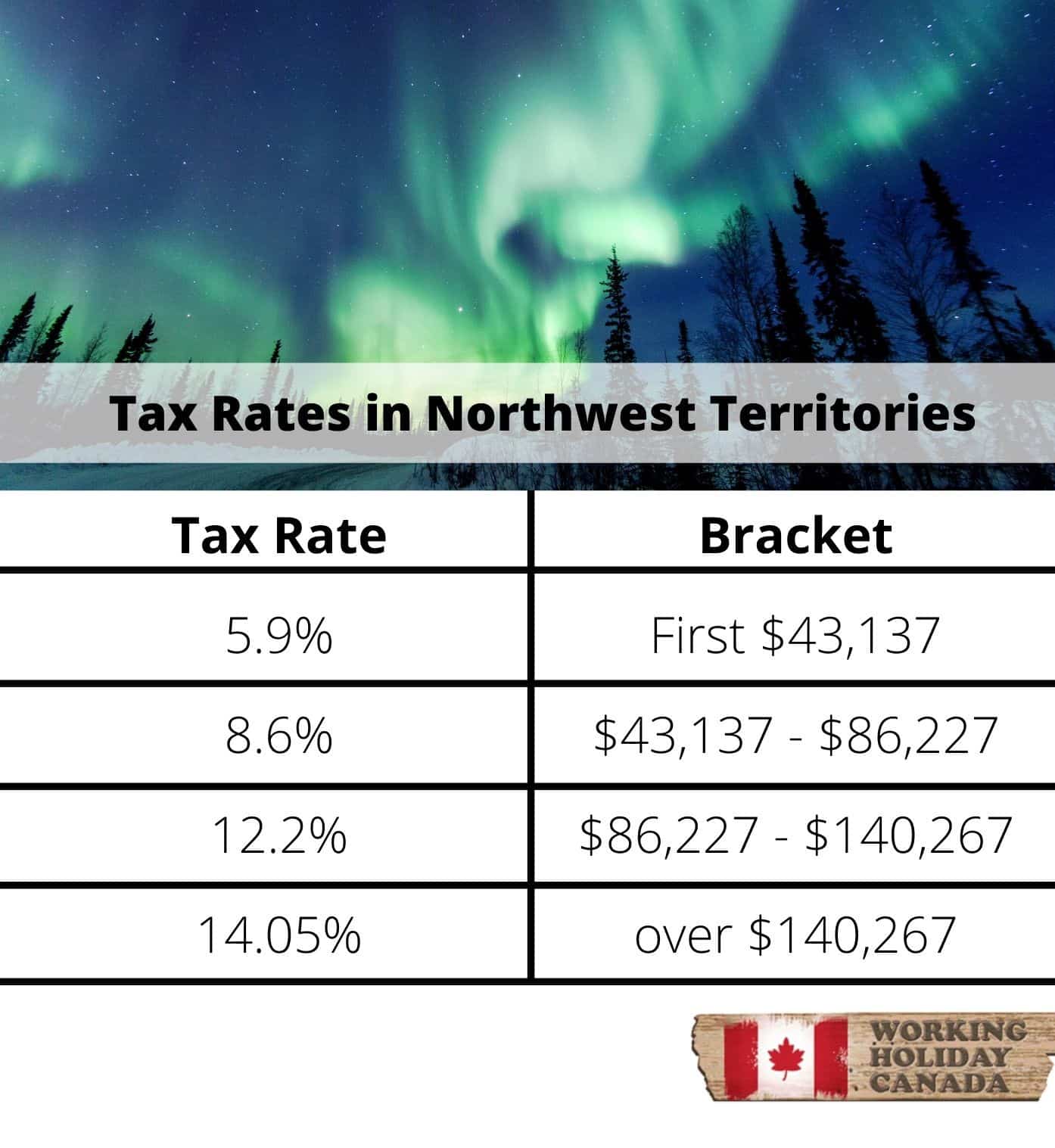

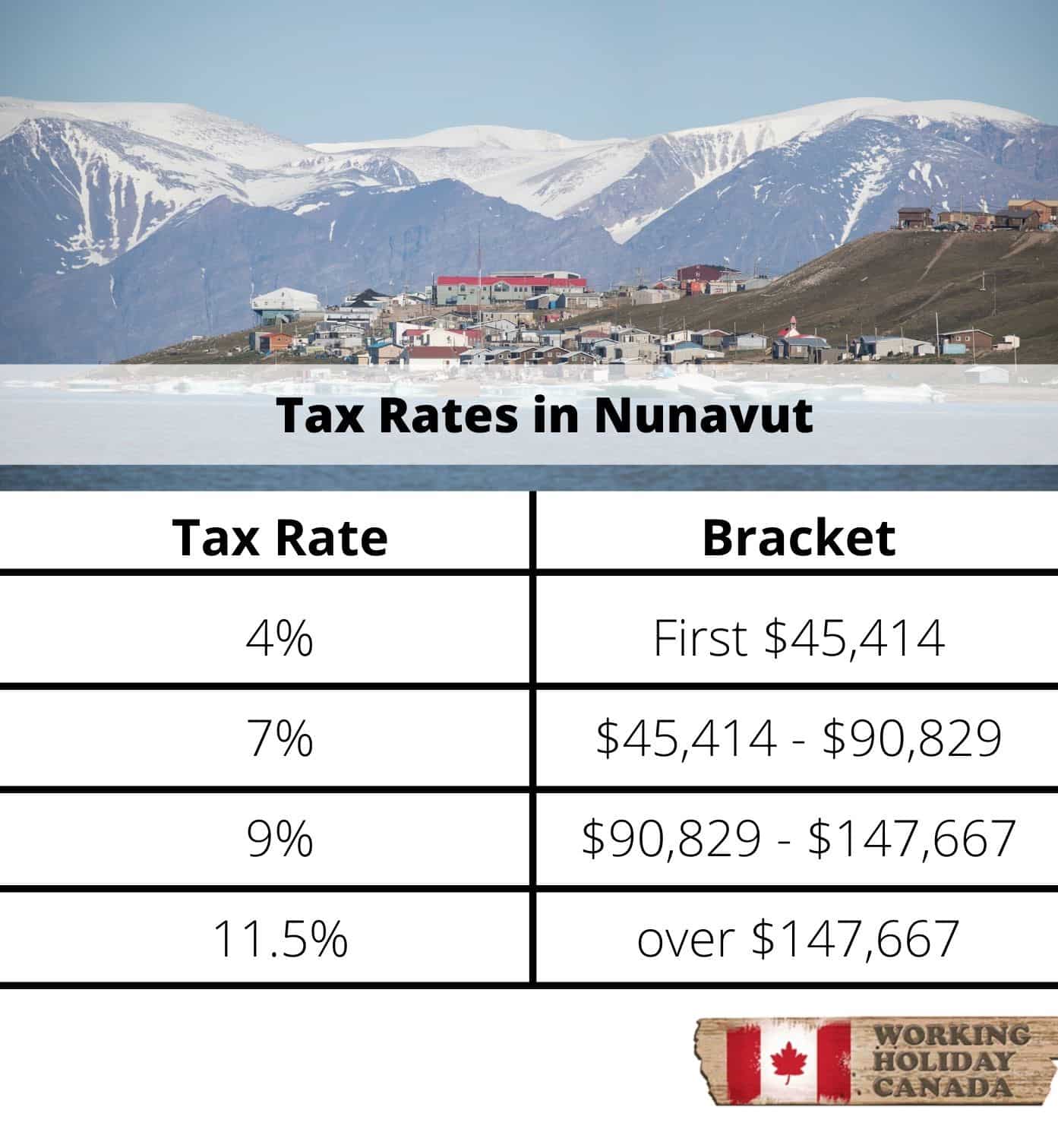

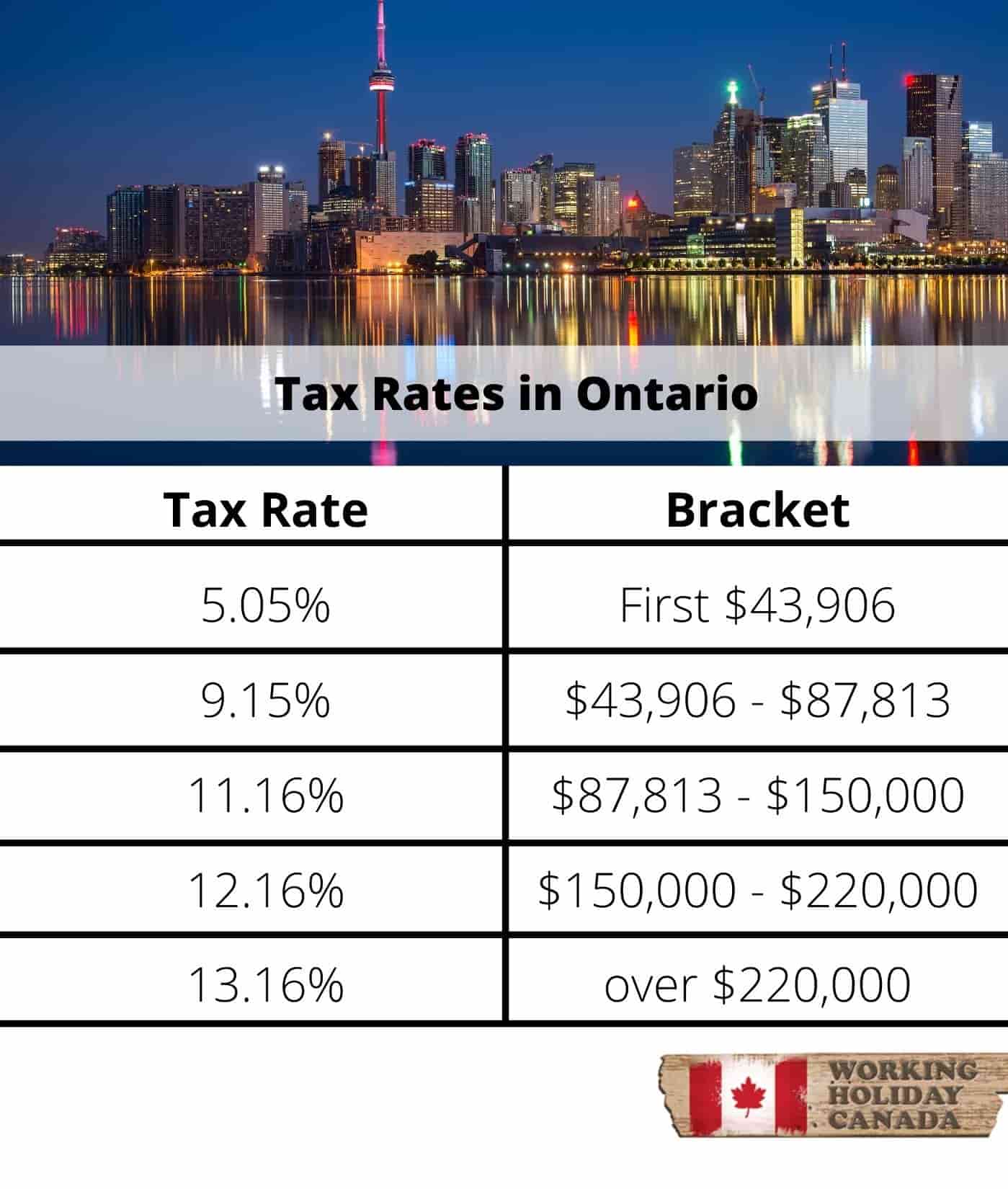

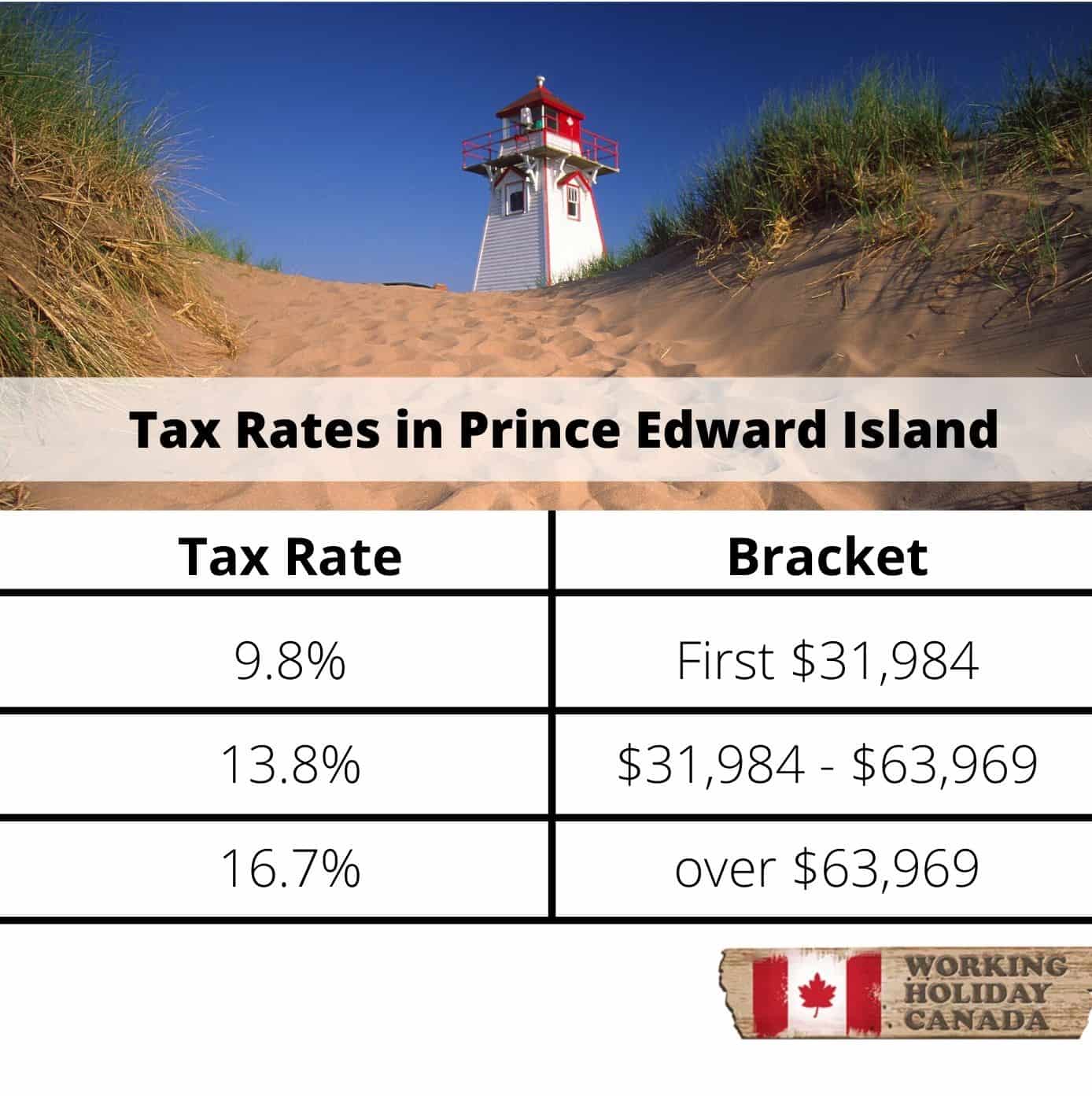

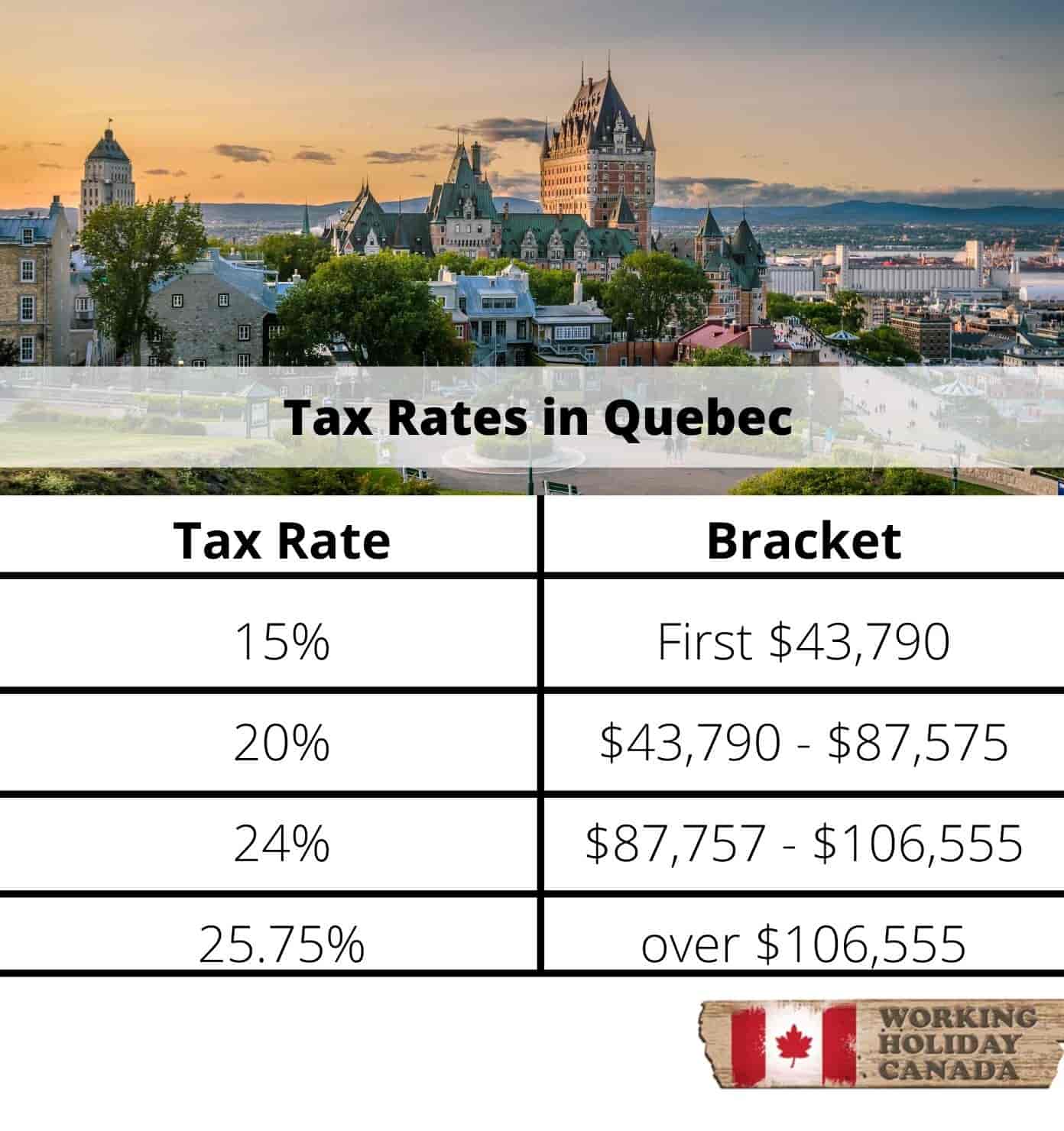

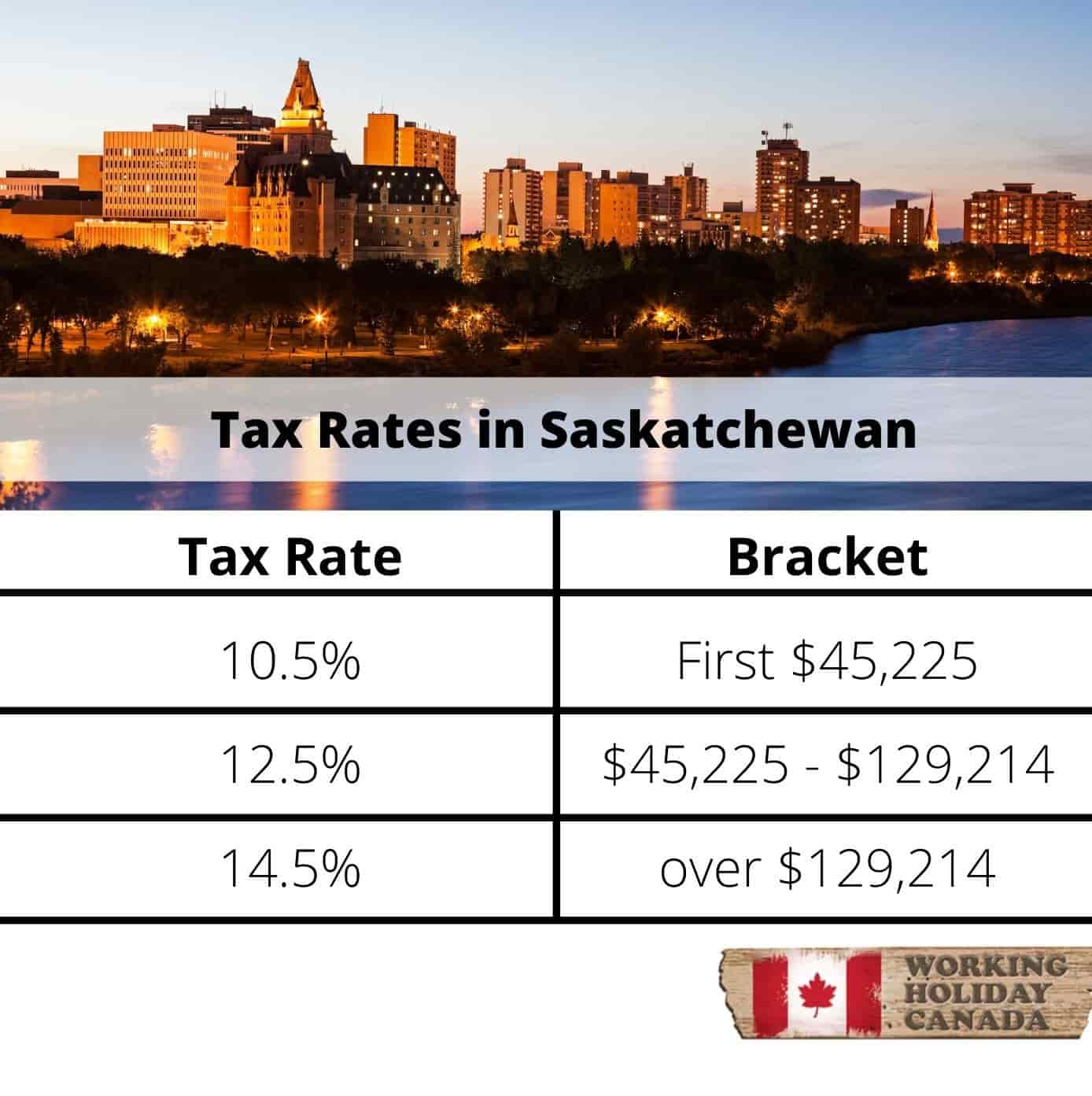

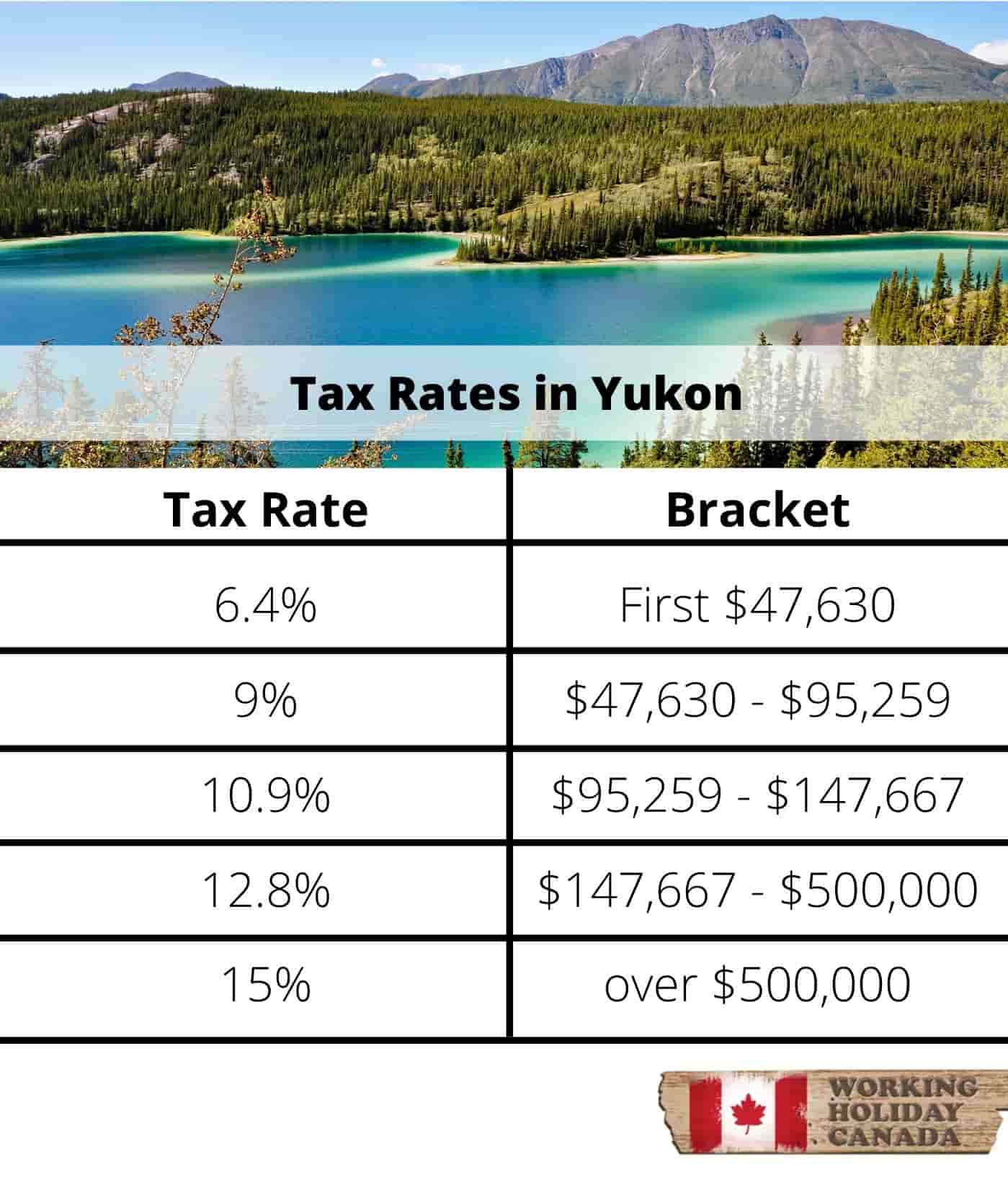

Provincial Tax Rates and Brackets

Canada Pension Plan

The Canada Pension Plan (CPP) provides contributors and their families with partial replacement of earnings in the case of retirement, disability or death. Most workers are required to contribute 4.95% of gross pay in CPP for each pay period.

Employment Insurance (EI)

The EI program provides temporary income support to unemployed workers while they look for employment or to upgrade their skills. Generally, all workers contribute 1.63% of gross pay in Employment Insurance (EI) for each pay period.

Q6 – Do I have any tax obligations in the US while I’m in Canada?

A – Yes! US citizens in Canada still have a tax filing requirement with the IRS in America.

You will be required to file your US tax return (Form 1040) every year, report your worldwide income to the IRS and pay any tax imposed by US law.

Generally, there will not be any excess tax to pay in the US as there are a number of systems in place to prevent double taxation on most types of income.

Foreign Earned Income Exclusion

As an American citizen in Canada, it’s likely that you will be entitled to avail of a foreign earned income exclusion from US tax (up to $104,100 in 2018 or even more if you incur housing costs).

The foreign earned income exclusion is available to expats who either:

- Work outside the US as employees

- Work outside the US in a self-employed or partner capacity

The aim of this exclusion is to help US expats to eliminate US tax on income that is earned while working abroad. The exclusion is only available for earned income and doesn’t apply to investment income such as interest and dividends.

The exclusion usually applies if you have lived abroad for at least one full year. However, you may be entitled to a partial-year exclusion if you return to the US mid-year.

Foreign Tax Credit

If your annual income is greater than the Foreign Earned Income Exclusion amount or you have earned ‘non-wage’ income, the Foreign Tax Credit can ensure that your income does not get taxed twice.

Foreign Tax Credit & Foreign Earned Income Exclusion

It’s important to choose between the foreign income exclusion and tax credit carefully.

If you claim the exclusion and then change back to the foreign tax credit, you can’t easily claim the exclusion again for five years.

Claiming the foreign tax credit might be the better option if any of the below apply to you:

- You’re paying foreign tax at a higher rate than your US tax rate

- You want to participate in an individual retirement arrangement (IRA)

- You qualify for certain family-related breaks based on non-excluded income

The foreign tax credit might also be a better choice for expats with small business operations that use capital or inventory as an important part of their business.

Q7 – What documents do I need in order to file my tax return?

A – Not only do Americans in Canada have a tax filing obligation in the US, they must also file a return in Canada, in case they have a balance due to the tax office.

Tips for filing your Canadian tax return

Your SIN and T4

When you file your Canadian tax return you will need to have your T4 document (or a final cumulative payslip) and your Social Insurance Number (SIN) at hand in order to file a tax return.

You must apply for a SIN before you start a job in Canada and include your SIN on your T4 slip.

If you have had multiple employers during the year you will need to ensure that you get a T4 from each of them.

Expenses

If you earned more than the tax-free allowance, then you may be able to claim on the cost of certain expenses to reduce your overall tax liability.

Examples of eligible expenses include:

- Medical (for example – visit to the doctor, prescriptions, and surgery)

- Travel (for example – monthly transit passes until 30 June 30)

- Tuition fees

- Donations

- Union dues

- Business (for example – rent, supplies, travel, and professional fees)

If you intend to use expenses to lower your overall tax liability you will need to ensure that you have proper documentation and receipts for each cost.

Q8 – How do I file my tax return?

A – You can file directly with the Canadian tax office, or you can file your tax return with a tax agent like Taxback.com.

The main benefit of applying directly yourself is that it’s free. But you’ll have to determine your residency status and gather all the necessary documents yourself. Plus the responsibility for the correct filing of your tax return lies with you also.

By applying with Taxback.com you can enjoy a fast and stress-free service. Taxback.com will handle all of the tax return paperwork, ensure you avail of every expense and relief you are entitled to and retrieve your maximum legal tax refund. What’s more, they can help you to locate any tax documents that you have lost. They can even help you to apply for your SIN before you start work in Canada!

Taxback.com has local offices in Banff and Whistler.

Q9 – Will I be entitled to a Canadian tax refund?

A – Generally speaking, you’ll pay three types of taxes in Canada.

- Income tax (displayed in box 22 of your T4)

- Canadian Pension Plan (CPP – box 16)

- Employer Insurance (EI – box 18)

If you have overpaid any of these taxes, you will be entitled to a tax refund.

Taxback.com can help you to get your maximum legal Canadian tax refund.

Q10 – What is the deadline for filing a tax return in Canada?

A – The deadline for filing a Canadian tax return is usually 30 April of the following tax year. In other words, the tax return you file on or before (you can choose to file from around mid-February) April 30th, 2021 will relate to income earned in 2020.

It is always advisable to file as early as possible and to avoid the ‘deadline rush‘.

Missing the deadline

If you don’t file your tax return on time, you could incur a penalty fee of 5% on top of anything you may owe to the Canadian government. If you’re entitled to a tax refund for the tax year there is no penalty for filing late and the term for filing your tax return is 10 years after the end of the tax year.

Want to claim a tax refund from Canada?