Being on a working holiday in Canada is definitely an unforgettable experience. Despite all of the fun and incredible memories working holidaymakers can have, they are other things that need to be kept in mind. Some of them concern the most important documents and forms. Below you will find useful information about:

- What You Need To Know About Canada Working Holiday Visa Applications

- Important Documents To Have While in Canada

- Canadian Tax Refund Forms And Documents

- How To Apply For Canadian Permanent Residency

Getting to Canada – Working holiday visa applications

Starting points

International Experience Canada (IEC)

The initiative through which a number of visas are offered – such as the Working Holiday Visa. The working holiday program allows people (from 18 – 30 or 35 at the time of application – the upper age limit depends on the applicant’s country of citizenship) from various countries around the world to temporarily work in Canada for 1 – 2 years.

CIC and IRCC

They mean the same thing and as you research your working holiday it’s likely you’ll see them used interchangeably. CIC stands for Citizenship and Immigration Canada, the government department responsible for working holiday visas. It was recently rebranded as Immigration, Refugees and Citizenship Canada (IRCC).

Participating countries

You must be a citizen (passport holder) of one of 35 participating countries that have a bilateral youth mobility agreement with Canada.

You’ll also need a valid passport for the duration of your stay in Canada. You will not be issued a work permit that is longer than the validity of the passport.

Money

You must have the equivalent of CAD$2,500 when you arrive in Canada to help cover initial expenses. Before entering Canada you’ll also need a return ticket or the financial resources to purchase a departure ticket for when your visa expires.

Insurance

Successful visa applicants must have health insurance during their time in Canada and it’s possible that you will be asked to present evidence of this at the point of entry to Canada. You may be refused entry if you don’t have insurance. If your insurance policy is valid for less time than your expected stay in Canada, you may be issued a work permit that expires at the same time as your insurance.

Other requirements

Each country that holds a bilateral agreement with Canada’s IEC program also has its own unique requirements in order to qualify. For example, if you live in Ireland, in order to be eligible for a working holiday visa you must be between the ages of 18-35 and the maximum validity period of your visa will be 24 months. Meanwhile, if you are applying from Belgium, you must be in the 18-30 age bracket and your visa will be valid for a maximum of 12 months.

The application

Apply directly with IEC

If you choose this option, make sure that you read all of the information, instructions, and FAQs on the IEC website. By following the application process step-by-step you should complete your application without any problems.

The first step is to become a candidate by creating a free online IEC profile.

Apply with an agent

If you’d rather not complete the application yourself, you can instead choose to enlist the help of an agent. Visa First is one example of an agent who can help you with your visa application.

There are also a number of companies in Canada that offer support with the visa application process as well as accommodation advice and orientation sessions on arrival. Of course, there is a higher cost involved with this option. But if you would prefer someone else to handle the process, this might be the option for you.

Pools

‘Pools’ are simply groups of the different countries and category types that are on offer. It is possible to become a candidate in as many categories as you are eligible for. However, most applicants only choose one pool.

When to apply for a visa?

Usually, all countries and programs (Working Holiday, Young Professionals and Internship – more below) open for entry in November or December of the previous year. So, if you would like to travel to Canada in 2020, you should be able to start the visa process in December 2019/January 2020.

Places are gradually filled in the months that follow. In some countries, where demand is high, the program closes in the spring or summer. Where supply outstrips demand, the pools will likely stay open until the close of the program.

The system draws applicants at regular intervals until all places are taken for the year. In other words, you can create a profile and become a candidate at any time after the opening date for your country. However, applying early is definitely a good idea. This will mean that your name is in the hat for a greater number of draws.

What happens next?

Rounds of invitations take place until there are no more spots available. All candidates must then wait to be selected from the IEC pools and be invited to apply for a work permit.

If you’re invited to apply, you’ll have 10 days to decide if you want to start the application process. And, if you do start the application process, you’ll then have 20 days to apply online for a work permit.

Once you submit your work permit application (including all required documents), pay the fees, an IEC officer will start reviewing your application.

You will be sent a biometrics instruction letter via your IRCC account after you submit your application. You will have 30 days upon receipt of the instruction letter to submit your biometrics at a Visa Application Centre.

If your application is refused you will receive a letter of explanation. But, if your application is approved, you’ll receive a port of entry (POE) letter of introduction and letter confirming the validity of your biometric information to your account.

Finally, it’s definitely smart to wait until you receive approval for your application before you buy a plane ticket or start making solid plans for your holiday. You don’t want to be stuck with a plane ticket and no work permit!

The POE letter

Your POE letter is very important. Remember to bring it with you to Canada and show it to a border services officer at the port of entry (airport, land border, etc.). You’ll also need this letter of introduction to receive a work permit when you enter Canada.

Cost

Becoming a candidate is free. However, as you advance through the process some fees will apply.

Firstly, you must pay for the IEC participation fee. This was CAN$153 for the 2020 season. Second, you must pay an open work permit holder fee. The cost of this fee will depend on the IEC category you are applying for (it’s common for this fee to be around CAN$100). And lastly, you must pay the biometrics fee CAN$85.

Other categories of visa

If the working holiday visa option is not the route for you, but you’d still like to experience life in Canada, there are two more possible categories of participation through bilateral agreements and arrangements under the IEC program. For both of these options below, the eligibility requirements for the Working Holiday visa in Canada also apply.

Young Professionals

The Young Professionals category is designed for post-secondary graduates, who wish to further their careers by gaining professional work experience in Canada. Participants must have a signed employment offer letter or contract of employment with a Canadian employer before applying. The employment offer must be within the applicant’s field of expertise, as outlined in their training.

International Co-op (Internship)

The International Co-op (Internship) category is designed for people who are currently studying at a post-secondary institution in their country of citizenship. Applicants must want to complete a work placement or internship in Canada in order to fulfil part of their academic curriculum.

They are considered to be registered students for the duration of the internship. Applicants must have a signed job offer letter or contract for a work placement or internship in Canada and visas issued under this category are generally valid for up to 12 months.

eTA

Passengers travelling to Canada by air may be required to make an online application for an Electronic Travel Authorization (eTA) before they are allowed to enter the country.

IEC participants from Canada visa-exempt countries who get their work permit on or after August 1, 2015, will automatically be issued an eTA, along with their permit.

While in Canada

SIN

A SIN is a nine-digit number that government agencies use in order to identify you. You’ll need it in order to pay taxes, or access government programs and benefits, like Employment Insurance (EI) and the Canada Pension Plan (CPP).

You will also need a Social Insurance Number (SIN) in order to legally work in Canada.

Organizing your SIN

The first step is to gather all the necessary documentation and bring these to your local Service Canada Office.

For example, temporary residents (such as working holidaymakers) will need to provide either their Canadian work permit or their Canadian study permit which indicates that they may accept employment.

Temporary residents will be issued with a Social Insurance Number in Canada beginning with ‘9’. The confirmation of SIN Canada letter will have an expiry date which matches the end-date on the immigration document.

You may apply for a SIN Canada by mail if:

- you live more than 100km from your nearest Service Canada office

Or

- extenuating circumstances prevent you from presenting in person

And

- another individual cannot submit an application on your behalf

Or

- if you are applying from outside Canada

Once your SIN application is approved you will receive a Confirmation of SIN Number letter.

Protecting your SIN

Your SIN is confidential. If it fell into the wrong hands it could potentially be used maliciously to obtain private information about you. So it’s important to only disclose your SIN when it’s essential to do so.

Employers, financial institutions, and government agencies will usually require your SIN for legitimate reasons, which include setting up your income tax and benefit arrangements.

It is not illegal for private companies to ask for your SIN in Canada, however, it is discouraged. Examples, where it is not required, include property rental applications, credit card applications, subscribing to phone or internet providers, or applying to a college.

If you are unsure why your Canadian SIN is being requested, it’s a good idea to offer an alternative proof of identity, and ask to speak to a manager if this is not accepted.

You May Also Like:

LOST YOUR SOCIAL INSURANCE NUMBER OR HAD IT STOLEN? – HERE’S WHAT TO DO

ITN

An Individual Tax Number (ITN) is a unique number that Canada Revenue Agency (CRA) uses to identify you for tax purposes if you aren’t eligible for a Social Insurance Number (SIN) (e.g. because you don’t have a study permit allowing you to work).

You should apply for an ITN if you need to:

- File a Canadian tax return

- File an application to waive or reduce Canadian withholding tax on payments that you receive

- Dispose of taxable Canadian property

An ITN can take up to 8 weeks to process so keep that in mind if you’re under time pressure. You can find more information about the Individual Tax Number in our detailed blog post.

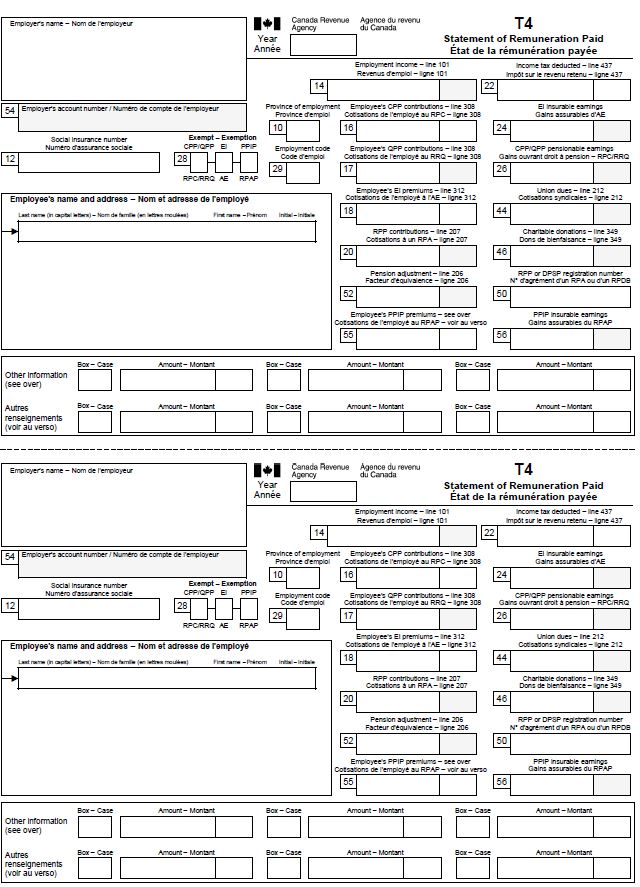

T4

Your T4 is an important slip of paper that you will need in order to file your tax return in Canada.

A T4 is a summary of the income that you earned and the tax that you paid in a particular tax year. If you work in multiple jobs in Canada you will receive multiple T4 slips. If you lose your T4, you should contact your employer directly.

Elements of a T4

- You will find your Employer Name in the top left-hand corner of your T4.

- To the right of the Employer’s Name, you’ll find the Tax Year in question (i.e. 2019, 2018, 2017, etc.).

- Your name and address will be located on the left of the T4

- Box 12 is where you will find your Social Insurance Number (SIN).

- The income you have earned in the job will be located in Box 14.

- The tax you paid on this income will be displayed in Box 22.

- Your Canadian Pension Plan (CPP) contributions are outlined in Box 16.

- And Box 18 is where your employer Insurance (EI) contributions are detailed.

Tax refunds

There are three boxes on your T4 that relate to tax that can be refunded – Boxes 22, 16 and 18.

Generally speaking, if you earned under the tax-free allowance for the tax year ($12,069 in 2019, $11,809 in 2018 – based on a single person with no income outside Canada), you will be entitled to be refunded the majority if not all of your income tax.

You will also be entitled to a refund for any overpayment in CPP (Box 16) or EI (Box 18).

Taxback.com guarantees to retrieve your maximum legal tax refund. Their average Canadian tax refund for working holidaymakers is $998.

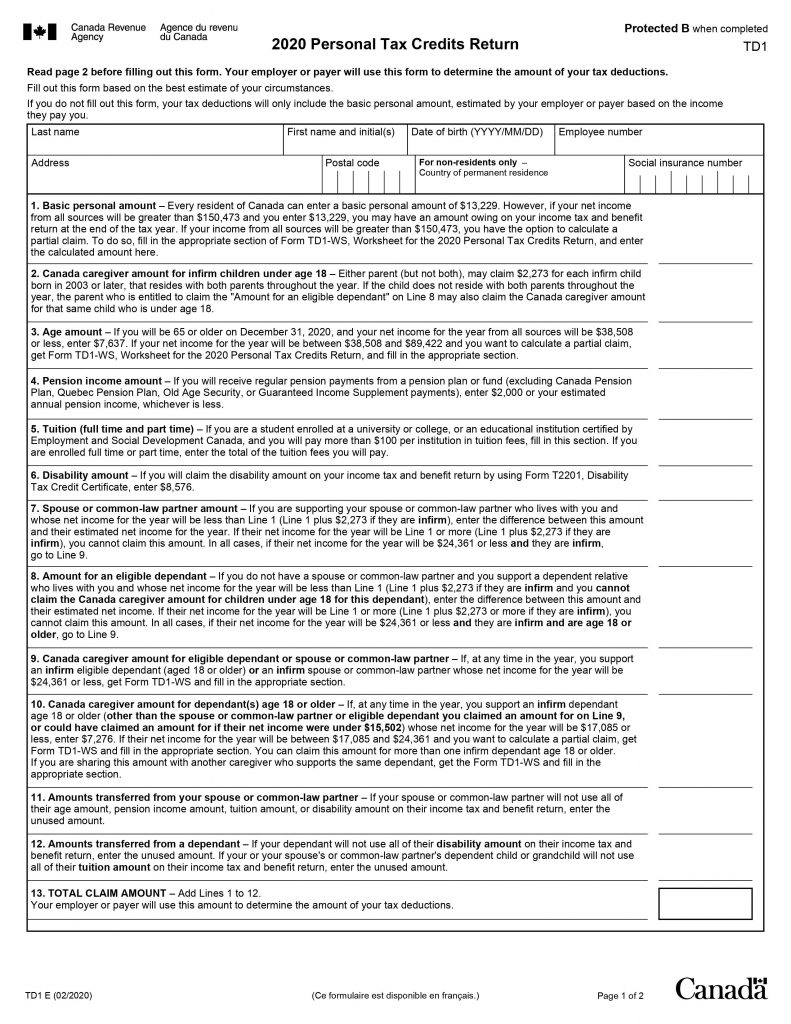

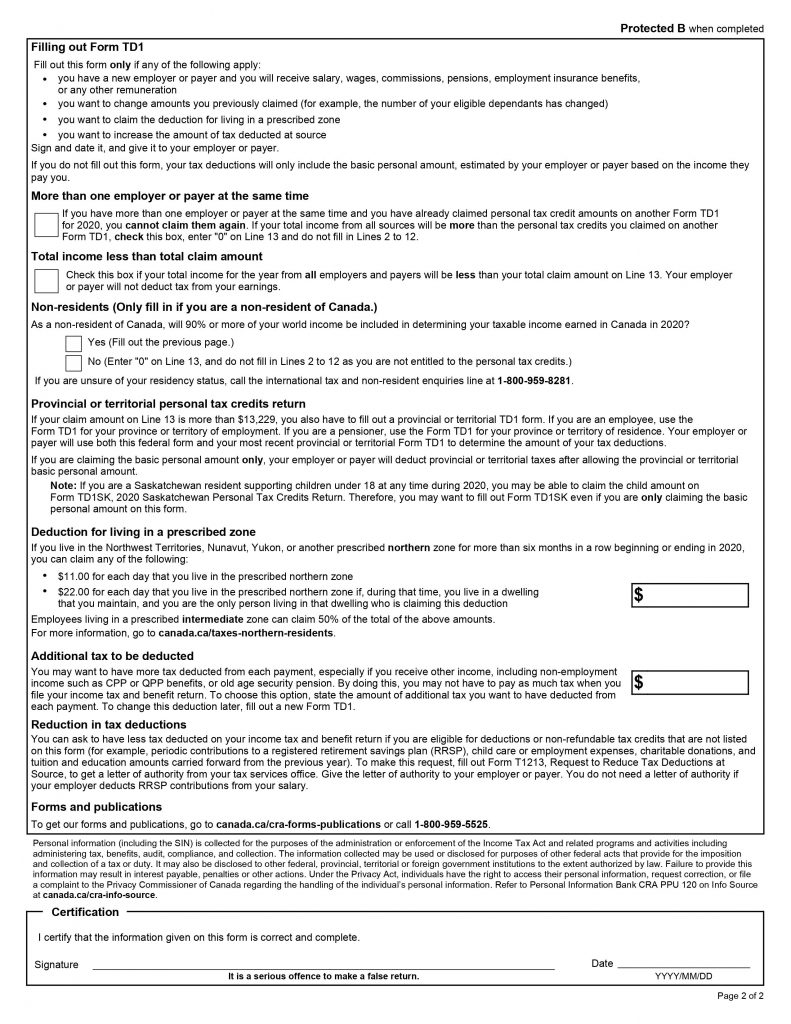

TD1

When you start your first job in Canada you will be required to fill in a TD1 form.

This is a federal and provincial and personal tax credit form used to determine how much tax you should pay on your income.

Your TD1 is very important and it is vital that it is filled out correctly as this could mean the difference between you getting a tax refund or owing tax to the Canadian Authorities.

When to fill out a TD1 form

You’ll need to complete a TD1 form:

- When you start a new job for the first time in Canada

- Anytime you have a new employer

- If you want to change the amounts from previous years

- If you want to claim the deduction for living in a prescribed zone

- If you want to increase the amount of tax deducted at source

The most common reason for filling out this form is when you change employers or start first-time employment in Canada.

There are two cases where you need to be extra vigilant when filling out the forms:

(1) You work outside Canada in the same tax year

If you earned income from outside Canada in the same year, you earned income from Canadian sources then you might not be entitled to claim the personal tax credits that allow you to earn tax-free income in Canada.

The key is to watch out for the 90% rule. Basically, if you didn’t earn 90% of your income in Canada for that year, then the Canadian tax authorities will not let you earn tax-free income for that year.

If you didn’t earn 90% of your income in Canada for that year then you should enter 0 in box 13 and tick ‘No’ on the non-resident question on the TD1 form.

If you don’t fill this out correctly, you could end up owing money to the tax authorities.

(2) You work two or more jobs at the same time in Canada

If you take up more than one job in Canada, then you’ll be asked to fill out a TD1 form for each job.

The important thing to remember is that you can’t claim personal credits twice.

So, if you’re entitled to personal tax credits, you should only claim them for one job. Usually, it’s most beneficial to claim the credits for the job the pays the most.

T1 General

The T1 Income Tax and Benefit Return or ‘T1’ is the form used in Canada by taxpayers to file their personal income tax return.

Individuals with tax payable during a calendar year must use the T1 to file their total income from all sources, including:

- employment income

- self-employment income

- foreign income

- interest

- dividends

- capital gains

- rental income

After applicable deductions, the net income and taxable income are determined, and federal and provincial or territorial tax are calculated to give the total payable.

The deadline for filing this tax return is usually April 30th.

There are 5 main elements to a T1 Income Tax and Benefit Return form:

- Identification – This is where you provide personal information like your name, address, Social Insurance Number and marital status.

- Total income – Here you declare your income from all sources.

- Net income – Here things like child care expenses and union dues are subtracted from total income

- Taxable income – Where allowable deductions are subtracted from your net income

- Refund or balance due – Here your credits are subtracted from net federal and provincial or territorial tax. You can then determine if you owe more tax to the Canadian Authorities or you are entitled to a refund.

The T1 Income Tax and Benefit form you fill in will be unique to you and your personal tax circumstances. There are a number of forms within the T1 that may need to be filled out depending on your circumstances.

For example, some of the most common forms for working holidaymakers are:

- 5013-R T1 2019 – Income Tax and Benefit Return for Non Residents and Deemed Residents of Canada

- 5013-D1 – Worksheet for the Income Tax Return

- 5013-SA T1 2019 – Schedule A – Statement of World Income – Non-Residents of Canada

- 5013-SB T1 2019 – Schedule B – Allowable Amount of Non-Refundable Tax Credits – Non-Resident of Canada

Staying in Canada – Applying for permanent residency

Starting points

Check if you are already a Canadian citizen!

Before you apply for permanent residency you should check if you already qualify for Canadian citizenship. Perhaps you inherited the status, through a parent or grandparent, without realizing it.

There’s actually a test you can take to find out if you qualify! Take the test.

Age

If you’re not over 18, it will be more difficult for you to gain permanent residency.

You’ll need your parent or legal guardian (a Canadian permanent resident who is either a Canadian citizen or applying to become one) to fill out an application for you.

You should note that even if you are a Canadian citizen you might be considered a non-resident for tax purposes in Canada. This might happen if you do not have significant residential ties in Canada or you have established such ties outside of Canada.

Significant residential ties are home available for you and/or family (spouse and/or children). If you are not a Canadian citizen and you want to establish in Canada you can apply for a permanent residency in Canada.

The application may take some time.

Don’t count on achieving permanent residency during your working holiday. It’s difficult to determine exactly how long it will take to complete the application process and become a permanent resident.

Understandably, this uncertainty can be frustrating if you’re in Canada on a working holiday and you want to keep working in the country after your current visa expires. Plus, there are never any guarantees that your application to become a permanent resident will be successful.

Express Entry

Canada’s fast-track program for immigration is called ‘Express Entry’. It’s designed specifically to help skilled workers to move into a role in the country.

Applications for Express Entry are done online. Once you create your profile (valid for one year) you will be given a score (you must achieve a minimum score of 67/100) based on your language proficiency, education, and work experience.

Your score is then ranked against other applicants via a Comprehensive Ranking System (CRS) and those at the top of the rankings are invited (Invitation to Apply (ITA)) to become permanent residents.

Once you receive an ITA, you will have 60 days to complete your application (which includes health and security checks) for permanent residency. If you are not invited to apply, don’t worry. You can renew your profile and return to the candidate pool for another 12 months.

The majority of applications are processed in under six months. Applicants may also be selected by a Canadian employer for a position, as long as the employer can show they can’t find a suitable Canadian or permanent resident.

There are three separate immigration programs under Express Entry – ‘Federal Skilled Workers’, ‘Federal Skilled Trades’, and ‘Canadian Experience Class’.

Federal Skilled Workers

This program is for applicants who work in one of the top occupations that are in demand in Canada.

This program is limited to 25,000 visas per year (all nationalities). Although, if you have a job offer, you can still qualify even if the quota has been filled. To apply you must have at least one year of paid work experience and fulfil certain criteria (such as a language test).

You must also have your qualifications assessed by an independent accreditor (for an additional fee).

Federal Skilled Trades

Each year 5,000 visas are available for individuals who are trained in one of 90 skilled trades that are in demand. To apply under this program you must have at least two years’ paid work experience (in the previous five years) and have either a job offer for a full year or a certificate of qualification.

Canadian Experience Class (CEC)

This program offers 8,000 permanent residency visas to applicants who have at least 12 months’ skilled work experience in Canada in the three years before they apply. To qualify you must also apply at least four months before your visa expires, and pass a language and medical test.

It takes six months to process but it is possible to get a bridging visa until the CEC is issued.

Other options to consider

1) Provincial Nominee Programme (PNP)

This program is a great option if you have a province in mind that you would like to immigrate to and settle in. Applicants must contact the representative immigration office within their preferred province and apply for a nomination to that province.

2) Family Class Immigration

If you have any members of the close family that are permanent residents in Canada, they may be able to help you obtain permanent residency. In fact, approximately 30% of all immigrants that come to Canada are sponsored by family members.

3) Business Immigration Programme

This program is open to the self-employed, experienced investors and entrepreneurs.

If you are a self-employed applicant, you must have the experience, intention, and ability to establish a business that will create an employment opportunity for yourself and that will make a significant contribution to cultural activities or athletics in Canada. Or alternatively, you can choose to purchase and manage a farm.

Investors must demonstrate a number of requirements including their business experience, a legally obtained net worth of C$800,000 and their intention to invest C$400,000 in the Canadian economy.

Entrepreneurs are also required to demonstrate business experience in owning and managing businesses or in owning a share or percentage of an enterprise. Their net worth must also be C$300,000, and they must be willing to manage and operate a business and create at least one full-time job (in addition to their own) within three years of becoming a permanent resident.

Cost

There are a number of fees to consider when you apply for permanent residency through the express entry system:

- Your application – $1,040

- Processing fee ($550) and right of permanent residence fee ($490)

- Include your spouse or partner – $1,040

- Processing fee ($550) and right of permanent residence fee ($490)

- Include a dependent child – $150 (per child)

- Medical examination $200

- Additional expenses (courier delivery fees and others) $160

Updated March 24, 2020