How to navigate the 2022 tax season?

Whether you are planning on going on a working holiday in Canada this year or are already in Canada as a backpacker this article will tell you what you need to know about your Canadian tax requirements in 2022.

This article will include important information on:

- Who pays tax in Canada?

- Tax year

- Tax deadline

- Do I have to pay tax on all my income?

- Can I save money on my tax bill?

- Income tax – rates and brackets (federal and provincial)

- What do I need to file a tax return?

- How do I file a tax return?

- Who pays tax in Canada?

Let’s start with the easy questions!

Everyone working in Canada will pay tax on their income. This includes working holidaymakers and other temporary visa holders.

Income tax is paid on earnings like wages, salary, commission, tips and investments.

Tax year

The Canadian tax year runs from 1 January – 31 December

Tax deadline

The deadline for filing taxes is the end of April the following year. For example, tax returns for the 2022 tax year will be due on 30 April 2023.

Although the tax deadline is 30 April, you can file your tax return from mid-February. The sooner the better!

Do I have to pay tax on all my income?

Tax-free allowance

In short- no!

Most taxpayers in Canada are entitled to a tax-free allowance of $14,398 for 2022, meaning you can earn up to this amount without paying federal tax on your income.

Then each province or territory has a different amount you won’t be taxed on – for 2022 this can range from $8,481 up to $19,369.

Can I save money on my tax bill?

Personal tax credits 2022

If you’re eligible for personal tax credits in Canada, you may be entitled to save some money on your tax bill.

In order to determine whether you can claim the credits, you must fill out a TD1 form when you start working in Canada.

You complete this form once you start a new job or if you change employers.

If you have more than one job, you can only claim from one of the jobs – make sure not to claim twice otherwise you will owe more tax.

The way to know if you can or cannot claim a personal tax credit is by understanding the 90% rule.

90% rule

Every working holidaymaker in Canada should be familiar with the 90% rule.

This rule states that if you have earned over 10% of your income outside of Canada you cannot claim personal tax credits.

For you to meet the 90% rule and claim your credits in full:

- You would have to earn 90% of your income in Canada during the tax year

or

- Not have earned any income in the country you were in prior to Canada

If you earned more than 10% of your income outside of Canada during the tax year, you should tick ‘No’ on the non-resident question on page two of the TD1 form and enter 0 in box 13.

Income tax – rates and brackets

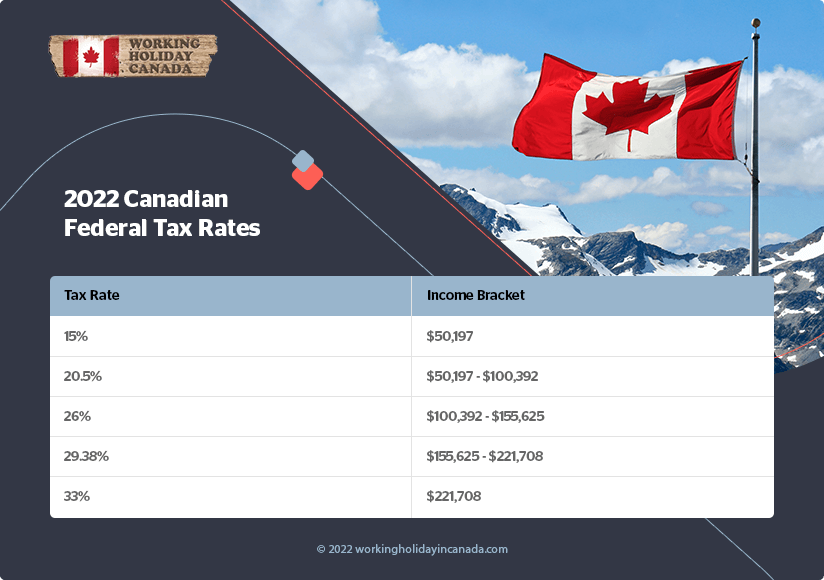

Note that there are two income taxes you need to be aware of: federal and provincial.

The federal income tax in Canada is conducted by the Canada Revenue Agency (CRA).

Federal income tax

There are different tax brackets that decide how much tax you will pay on your income. The more you earn, the higher your top rate of tax will be.

See the federal tax rates for Canada 2022 below:

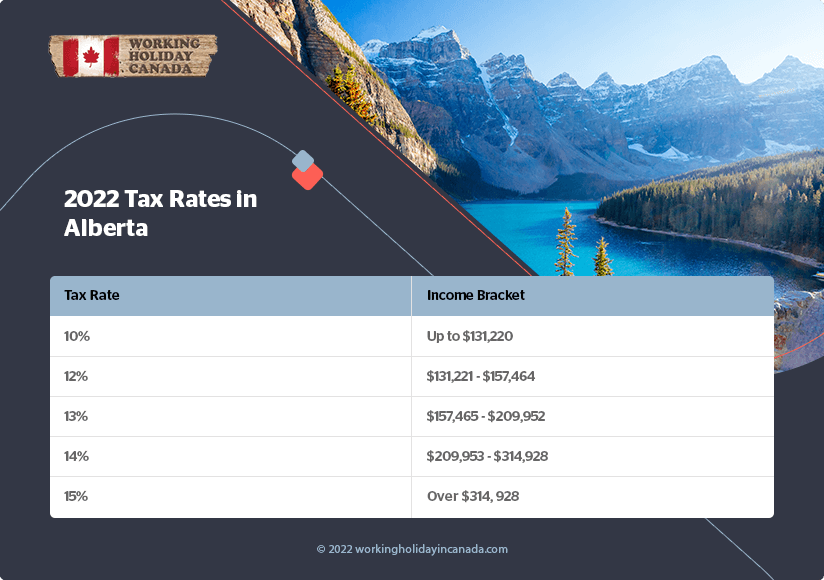

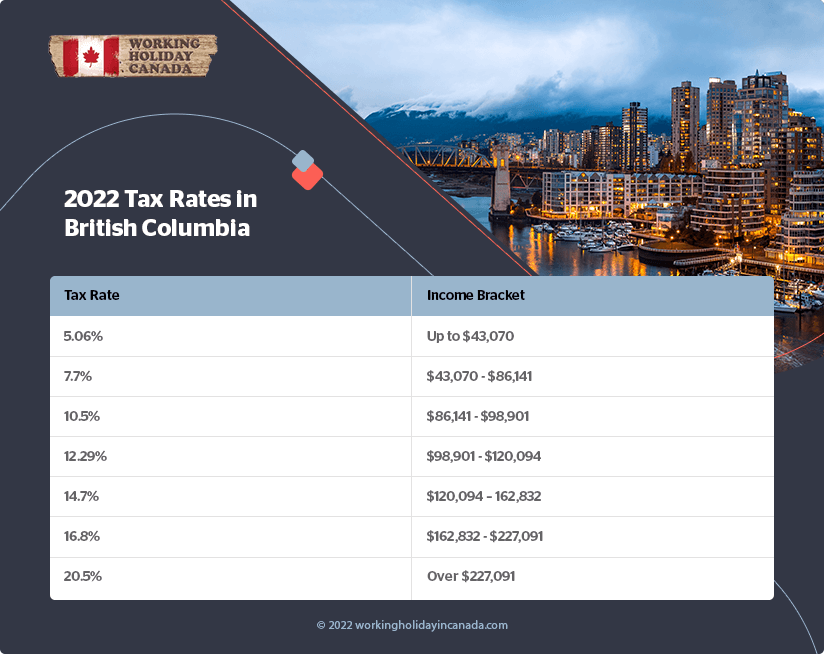

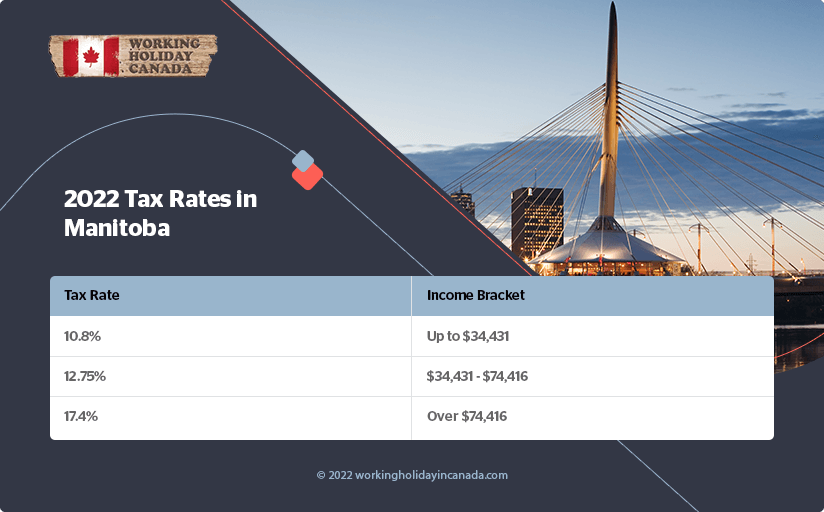

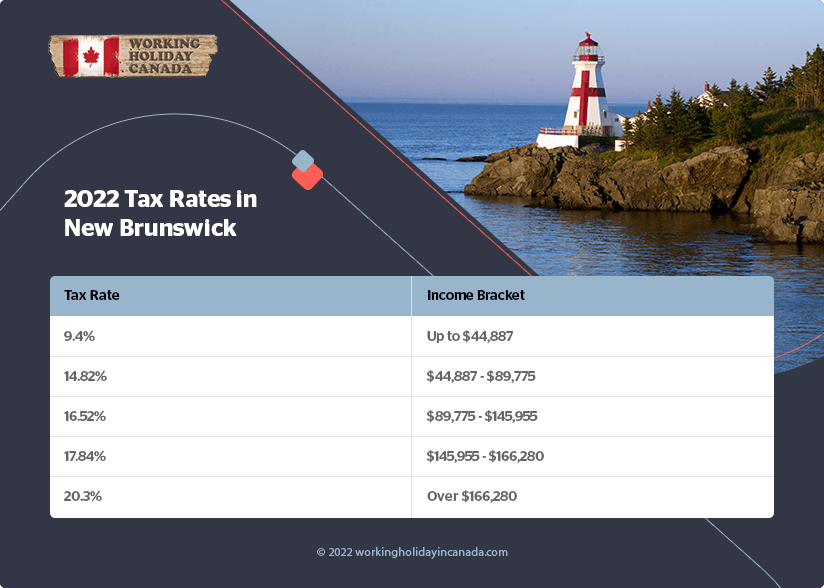

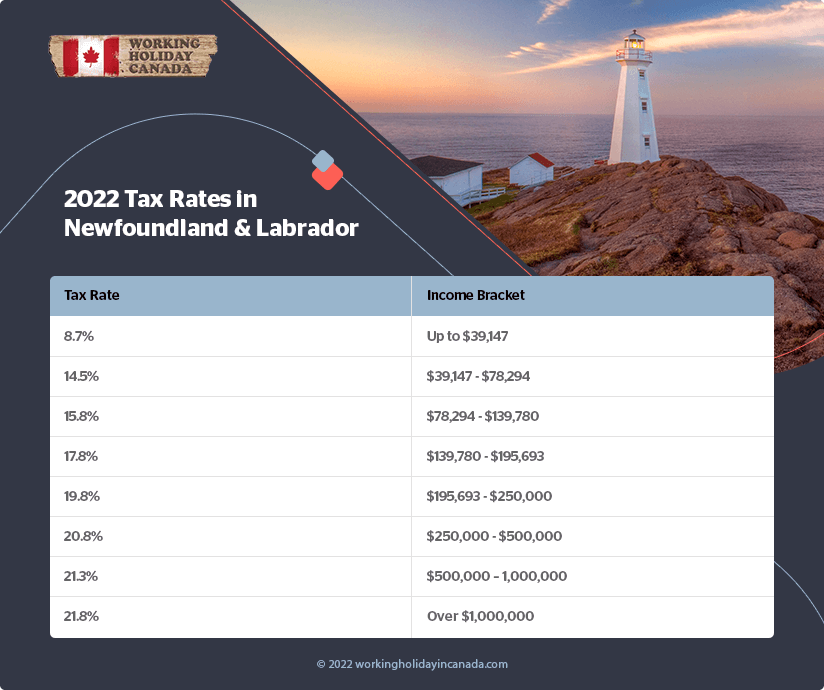

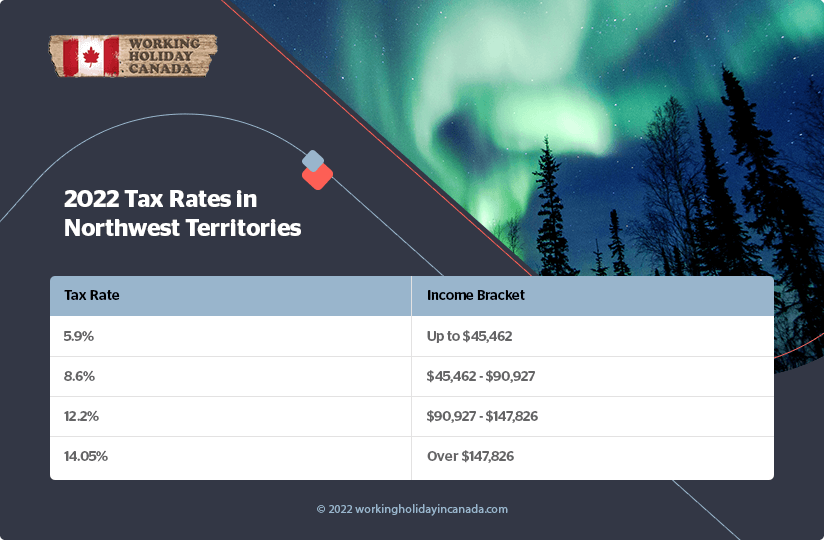

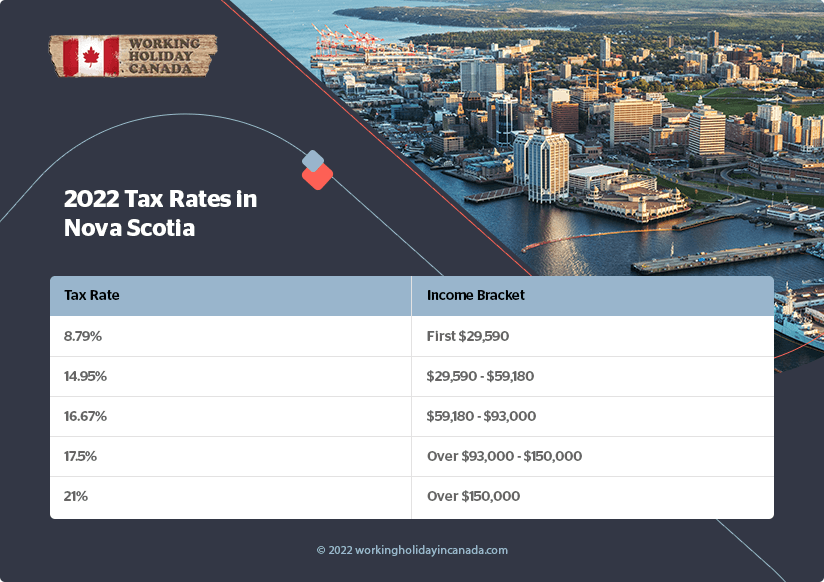

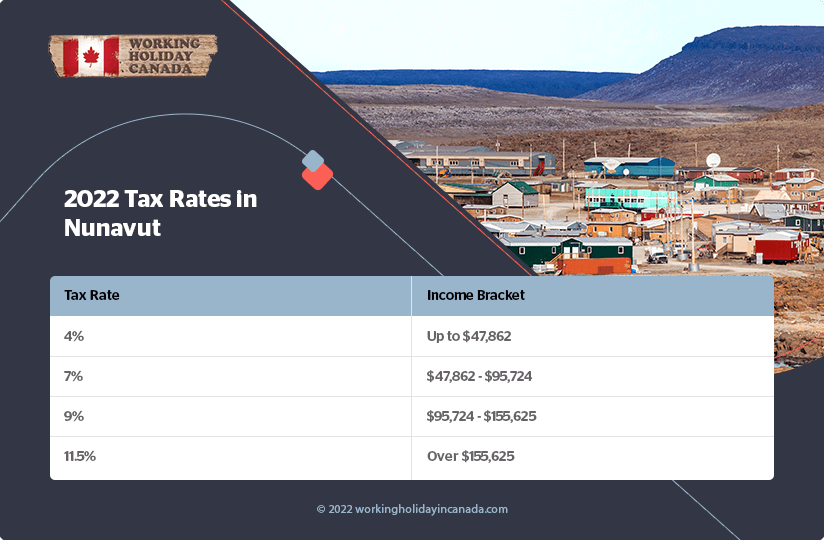

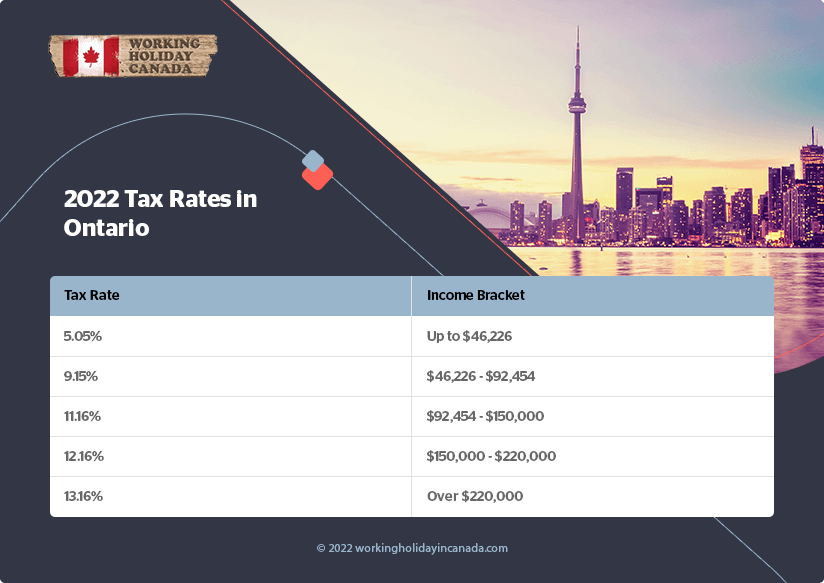

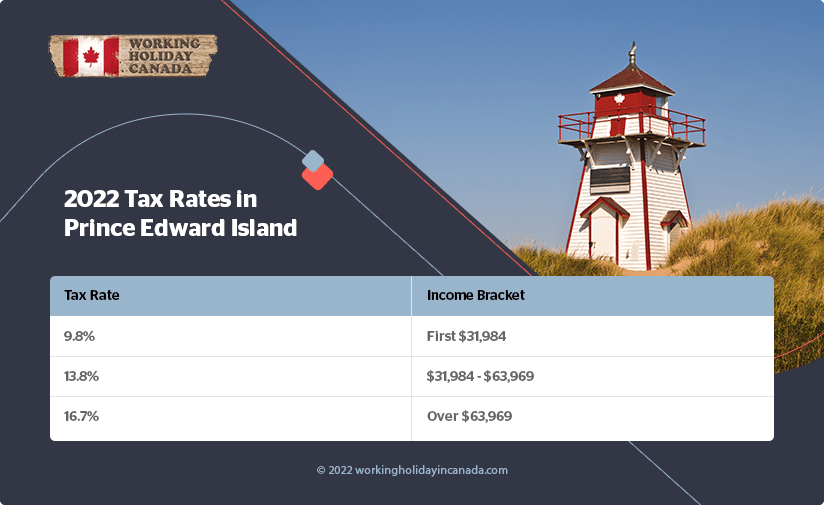

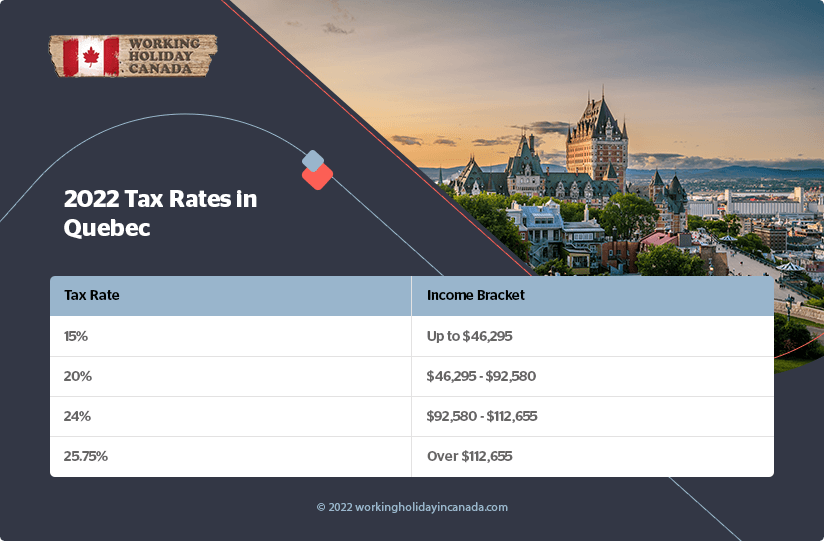

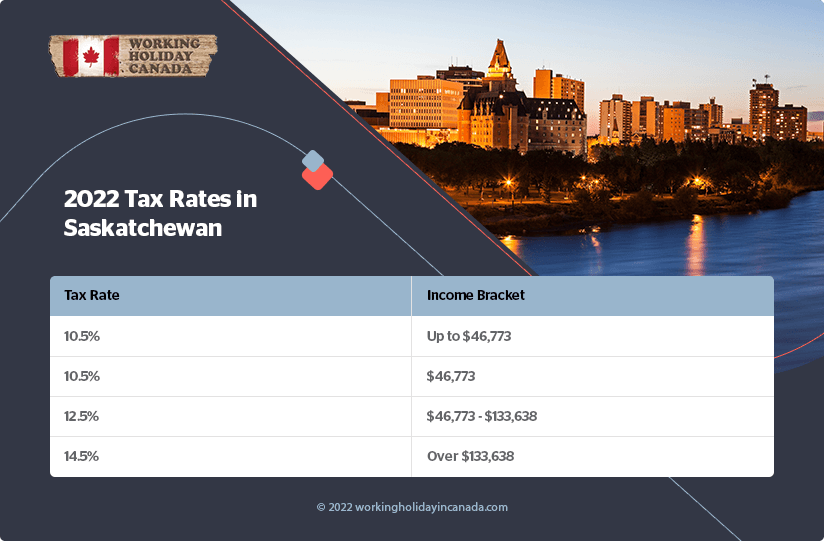

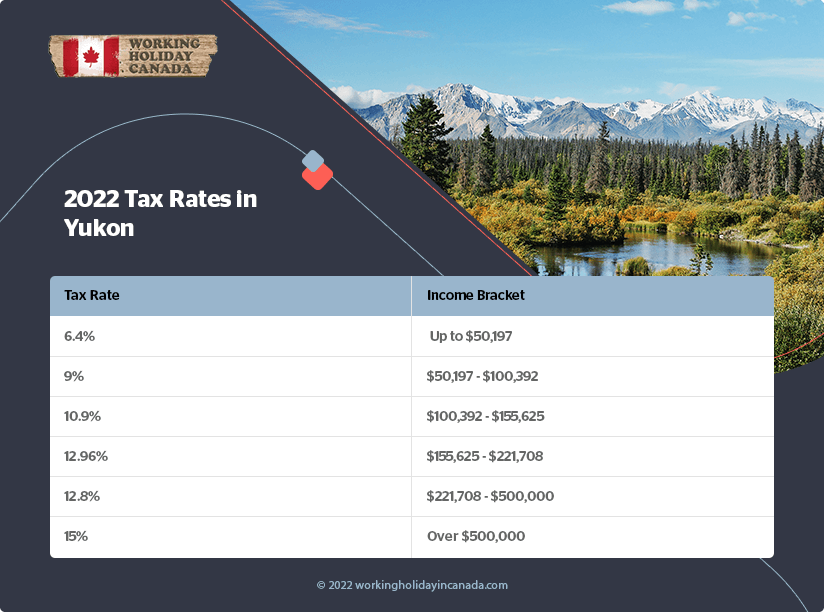

Provincial and territorial income tax

Alongside your federal tax, there is also provincial or territorial tax you have to pay.

You must remember that tax rates can differ based on the province or territory you are located in.

The rate you will be taxed depends on what province you live in on 31 December.

There are 10 provinces and three territories in Canada.

Here are the tax rates for each one for 2022:

What do I need to file a tax return?

Determine your residency status

Before filing a tax return it’s really important that you know your residency status!

For tax purposes, you’re either a resident or non-resident.

Although your residency status depends on your individual circumstance, we’ll provide some guidance below.

You are considered a non-resident if you:

- Normally, customarily or routinely reside in a different country

- Stayed in Canada no more than 183 days during the tax year

- Don’t have any ties in Canada AND you live outside Canada during the tax year

Ties to Canada include having a spouse or a common-law partner, owning or renting a house or an apartment, etc.

You are considered a resident if you normally, routinely or customarily reside in Canada.

Generally, if you’re a working holidaymaker, you’ll be considered a non-resident for tax purposes, however, there are exceptions and each individual case is different as you’ve seen above.

To find more information you can read this article on determining your residency status.

Documents you’ll need as a working holidaymaker

To file a tax return you’ll need a T4 slip and your Social Insurance Number (SIN).

T4 slip

A T4 slip is a document that you obtain from your employer which outlines your income and the amount of tax you paid during the year.

It’s given to you by your employer after the end of the tax year (usually in February).

Note that if you have had multiple employers during the year you will need to ensure that you get a T4 from each of them.

SIN

Your SIN is a nine-digit number that you need to work and pay taxes in Canada.

You may also be able to obtain government services or benefits with your SIN.

In Canada, you have to obtain a SIN before starting a new job so that you can provide it to your employer.

So by the time you get to file your taxes, you should have your SIN ready to go!

Learn more about it in our detailed guide on Canadian SIN.

How do I file a tax return?

Remember that the deadline to file a tax return is 30 April.

When it comes to filing a tax return you can apply directly with the Canadian tax office.

But why not let Taxback.com, a group of tax experts take care of this for you?

Although getting tax back is great, the process can often be time-consuming, boring or even stressful.

They will make sure you are returned the maximum tax you are owed and ensure compliance with your visa conditions!

Why file with Taxback.com?

- Your maximum tax refund guaranteed – the average refund is $998

- It’s a fast and stress-free service

- You’ll have your personal tax agent that will support you throughout the process

- If don’t get a refund, there will be no fee

- They offer 24/7 live chat support for your tax questions

Updated On: 19.04.2022