Have you earned foreign income and are now on working holiday in Canada?

We get asked the “foreign income” question a lot, and thankfully because we have friends in high places, or rather we have friends who work in high places; we have the answers for you.

Here’s what you should do when filing your Canadian tax return.

We’re gonna do our best to explain this because as much as we don’t want it to be, it can be confusing! *Enter Mark Wahlberg*

Here we go!

*To be clear when we mention “same year” or “tax year” we mean January 1st to December 31st of any given year – which is the tax year in Canada.*

As with everything, there are different rules for residents and non-residents. Not sure about your residency status? See our blog post on determining your status.

You May Also Like:

Important dates in the Canadian tax year

Non-Residents

- Income earned outside of Canada must be declared on your Canadian tax return

- You will not be “taxed” on your foreign income, but it will affect the amount of non-refundable tax credits that you are eligible to claim. What does this mean?

The non-refundable tax credit we refer to is your basic personal credit, more well-known as the tax-free threshold. In Canada, you are allowed to earn up to a certain amount and not pay tax.

You can earn up to $ 12,069 (for 2019) without paying federal tax on your income.

- Here’s the deal. The Canadian tax office will allow you to earn up to $12,069 tax-free in the tax year if 90% or more of your earnings for that year were earned in Canada.

If the amount you earned outside of Canada is 10% or less of your total income for that year, this is good news.

If you earned more than 10% outside Canada, unfortunately, you won’t be eligible to earn any tax-free income up to a total amount of $12,069 (in 2019). Make sense?

- The plot thickens. If you have already been claiming these credits/ or this tax-free income from your employer, then you will have underpaid tax in Canada. And it all comes back to that confusing tax form that’s given to you before you start a new job that asks you to tick a few boxes and carry forward a number to the bottom right box.

This is called a TD1 form. You’ll actually fill out 2 of them, a federal (TD1) and a provincial (TD1BC, TD1AB, TD1ON, etc.) But we’ll concentrate on the federal tax form for now.

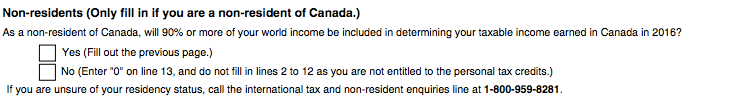

*Note: This is on the second page of the TD1 form

This is the part that gets tricky. As you can see from the above image, they ask you if you will earn 90% of your income in Canada. If yes, then you can claim the credits.

If no, and you will earn/or have earned 10% or more outside of Canada, you should tick NO and therefore not claim the credits. You will be fully taxed, but believe me, this is preferable to owe money when you go to file your tax return.

Disaster strikes here because a lot of non-residents don’t fully understand this when they are filling it out, and therefore claim credits that they are ineligible for.

This is why some non-residents will end up owing money to the Canadian tax office.*

*Note: This is only one of the reasons why non-residents will owe money, but it is the most common reason.

Residents

- Income earned outside of Canada must be declared on your Canadian tax return

- You will be taxed on this income

- If you are an immigrant in the tax year (i.e. move to Canada with the intention to settle and build a life in Canada), you will only be taxed on the income that you earned after you became a resident. Anything earned up to that point should still be declared, but it won’t be taxed. This income will be treated as if you were a non-resident (see above).

FAQ’s

Q: I earned income in my home country and then came to Canada in that same year. Should I include this income in my Canadian tax return?

A: Yes.

Q: I already paid tax on this foreign income in my home country. Does this make a difference?

A: No.

Q: Am I going to pay tax on the income I earned at home, in Canada?

A: No. There are tax treaties for a reason, you won’t be double-taxed on this income.

Q: Why does the tax office in Canada want to know what foreign income I earned?

A: They use your foreign income to calculate the amount of non-refundable tax credits that you are eligible to claim in Canada.

Q: If I earn income outside of Canada in the same tax year and I include it in my tax return, what difference will it make to my refund?

A: This answer really depends on your individual circumstances. In most cases, it will reduce your refund. In some cases, it may mean that you will have an underpaid tax on your Canadian income after the non-refundable tax credits were recalculated.

Q: What do I declare? My Net or Gross income from my home/another country?

A: You should declare your NET income, i.e. the income you received in your bank account or by cheque.

Got any another questions? Let us know and we’ll add to the FAQs. Alternatively, you can call the Canadian tax office or ask an agent such as Taxback.com

You may also like:

The T4 explained